The Rise of PayPal Analyzing the Company’s Revenue and Growth Strategies

With the rise of e-commerce, online payment systems have become an integral part of our daily lives. And when it comes to online payments, one name that stands out is PayPal. Founded in 1998, PayPal has grown to be one of the most popular and trusted online payment platforms in the world. From small businesses to large corporations, PayPal has become the go-to option for individuals and organizations alike.

In this article, we will take a deep dive into PayPal’s revenue and growth strategies. We will analyze the company’s financials, explore its market share, and understand the key factors that have led to its success. So let’s get started and unravel the story of PayPal.

Financial Overview of PayPal

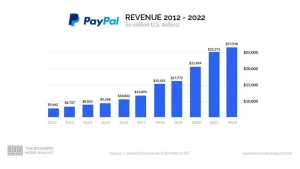

Before we delve into the details of PayPal’s revenue and growth strategies, let’s first take a look at the company’s financials. According to PayPal’s 2020 annual report, the company reported a revenue of $21.45 billion, representing a year-over-year increase of 22%. This marked the seventh consecutive year of double-digit revenue growth for PayPal.

Moreover, PayPal’s net income for 2020 was $4.2 billion, which was also a significant increase from the previous year. This demonstrates the company’s strong financial performance and its ability to generate profits consistently.

But what makes PayPal stand out in the crowded fintech space? Let’s find out.

Diversified Business Model

One of the key factors behind PayPal’s consistent revenue growth is its diversified business model. Unlike traditional e-commerce companies, PayPal’s revenue streams are not solely dependent on the sale of goods and services.

PayPal offers a range of products and services, including payment processing for merchants, peer-to-peer payments, and lending options. This diversified approach has allowed PayPal to tap into different markets and cater to a diverse customer base.

Moreover, PayPal has also expanded its reach by partnering with various popular platforms and marketplaces. For instance, PayPal is the preferred payment option on e-commerce giant eBay, which allows the company to tap into millions of potential customers.

Expanding Customer Base

Another significant contributor to PayPal’s revenue growth is its expanding customer base. As of 2020, PayPal had over 377 million active accounts worldwide, representing a 24% increase from the previous year.

The company’s focus on providing seamless and secure payment options has attracted a vast number of customers, including both businesses and individuals. PayPal’s user-friendly interface, along with its robust security measures, has made it a preferred choice for online transactions.

Moreover, PayPal has also expanded its reach to emerging markets, such as India and China, where online payments are gaining traction. This has allowed the company to tap into new markets, further boosting its revenue growth.

Strong Brand Reputation

PayPal’s success can also be attributed to its strong brand reputation. The company has built a trustworthy and reliable image among its customers, which is crucial in the fintech industry.

PayPal has been consistently ranked as one of the most trusted payment providers, owing to its rigorous security measures and fraud prevention techniques. This has helped the company build a loyal customer base, who continue to use PayPal’s services for their online transactions.

PayPal’s Market Share

Now that we have discussed PayPal’s financial performance let’s look at its market share. According to Statista, PayPal holds a dominant share in the global digital payment market, with a 21% share in 2020. This makes PayPal the leading player in the digital payment space, followed by companies like AliPay and WeChat Pay.

But PayPal’s dominance is not limited to the global market; the company also has a stronghold in the US. As per a report by eMarketer, PayPal is projected to have a 63.3% share of mobile proximity payment users in the US by 2025.

This impressive market share can be attributed to PayPal’s strong brand reputation and its trusted payment services. Moreover, the company’s partnerships with popular platforms and merchants have also helped it gain a significant market share.

Competition from Other Players

While PayPal holds a dominant position in the digital payment market, it faces fierce competition from other players, both old and new. Traditional financial institutions, such as banks, are now offering their own digital payment solutions, which poses a threat to PayPal’s market share.

Moreover, companies like Stripe and Square have also emerged as major competitors, offering similar services to PayPal’s merchant processing and peer-to-peer payments. However, PayPal’s established brand reputation and diverse product offerings have helped it maintain its market dominance so far.

Expanding into New Markets

In order to maintain its market share and stay ahead of the competition, PayPal has been actively expanding into new markets and services. In recent years, the company has ventured into the cryptocurrency space, allowing customers to buy, hold, and sell cryptocurrencies through its platform.

Moreover, PayPal has also entered the buy-now-pay-later market with its acquisition of Honey Science Corp. This move has allowed the company to cater to the growing demand for flexible payment options among millennials and Gen Z consumers.

Growth Strategies of PayPal

Apart from its diversified business model and expanding customer base, PayPal has also implemented various growth strategies to sustain its revenue growth. Let’s take a look at some of these strategies in detail:

Acquisitions and Partnerships

One of the key strategies adopted by PayPal is to acquire or partner with companies that complement its existing services. For instance, PayPal acquired Venmo, a popular peer-to-peer payment app, in 2013, which has helped the company expand its reach and customer base.

Moreover, PayPal also partnered with popular brands like Uber and Facebook Messenger to offer in-app payments, providing customers with a convenient and secure payment option. These partnerships have not only boosted PayPal’s revenue but have also helped the company stay ahead of its competitors.

Focus on Innovation

Innovation is at the core of PayPal’s growth strategy. The company constantly looks for ways to improve its services and offer new and innovative products to its customers.

For instance, PayPal launched “One Touch,” a feature that allows customers to make purchases without repeatedly entering their login credentials. This simplified checkout process has improved the user experience and increased conversion rates for merchants.

Moreover, PayPal has also invested in technologies like artificial intelligence and machine learning to enhance its fraud detection capabilities and provide a more secure platform for customers.

Analyzing PayPal’s Revenue Growth

Now that we have explored PayPal’s financials, market share, and growth strategies, let’s take a closer look at the factors that have contributed to its revenue growth over the years.

Increase in Online Transactions

With the rise of e-commerce, online transactions have become the preferred mode of payment for many consumers. And PayPal has been at the forefront of this trend, offering a secure and convenient online payment solution.

The COVID-19 pandemic has further accelerated the shift towards online transactions, as people are avoiding physical contact and opting for contactless payments. This has resulted in a significant increase in PayPal’s transaction volume, leading to a surge in its revenue.

Rise in Mobile Payments

Mobile payments have also played a crucial role in PayPal’s revenue growth. With the increasing use of smartphones, more and more customers are opting for mobile payment options. And PayPal’s mobile app provides customers with an easy-to-use and secure platform for making payments on the go.

Moreover, PayPal has also invested in improving its mobile app’s user experience, making it more convenient and user-friendly. This has resulted in an increase in the number of transactions made through the app, contributing to the company’s revenue growth.

Expansion into New Markets

As mentioned earlier, PayPal has actively expanded into new markets, both geographically and in terms of products and services. This has allowed the company to tap into new customer segments and cater to their needs, resulting in increased revenue.

Moreover, PayPal’s expansion into emerging markets like India and China has also opened up new opportunities for growth. With the increasing adoption of digital payments in these countries, PayPal is well-positioned to capitalize on this trend and drive its revenue growth further.

Conclusion

In conclusion, PayPal’s revenue growth can be attributed to its diversified business model, expanding customer base, strong brand reputation, and effective growth strategies. The company has consistently shown impressive financial performance, and with its focus on innovation and partnerships, PayPal is well-equipped to maintain its position as one of the leading players in the fintech industry. As online transactions continue to rise, we can expect PayPal’s revenue to grow even further in the coming years.

Post Comment