Mastercard Revenue Statistics Analyzing the Growth and Success of a Global Payment Company

In today’s digital age, it’s hard to imagine a world without credit and debit cards. These small plastic cards have become an integral part of our daily lives, allowing us to make purchases easily and securely. And while there are various payment companies in the market, one stands out as a leader in the industry – Mastercard.

Mastercard is a multinational financial service corporation that provides electronic payment solutions to customers worldwide. It has been in operation for over 50 years and has established itself as a major player in the global payments landscape. In this article, we will delve into the revenue statistics of Mastercard, examining its growth and success over the years. So, let’s begin our journey into understanding the impressive numbers behind Mastercard’s operations.

Overview of Mastercard’s History and Operations

Overview of Mastercard’s History and Operations

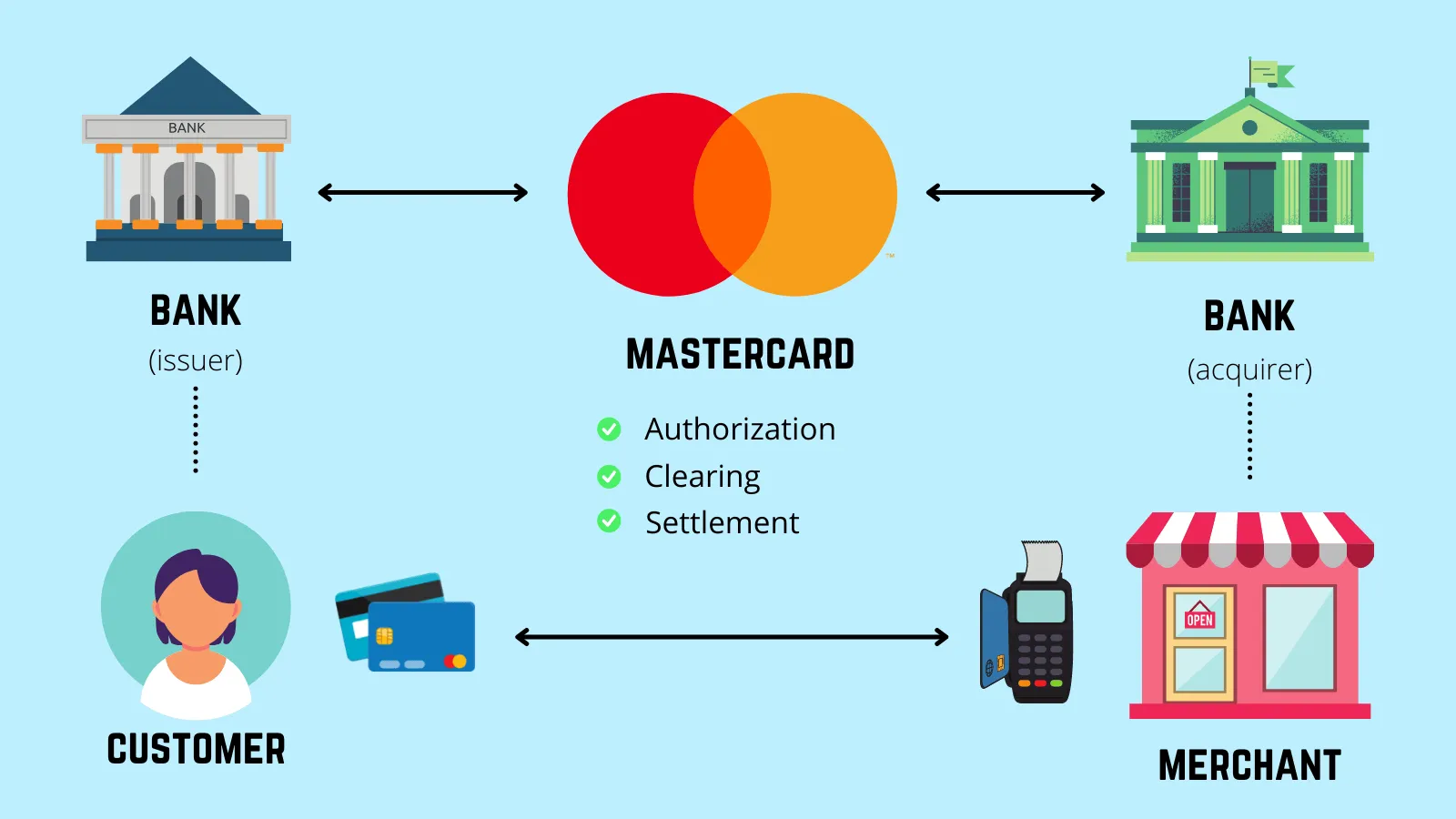

Before diving into the revenue statistics, it’s essential to understand the history and operations of Mastercard. The company was founded in 1966 by several California banks who created an interbank “Master Charge” program. It wasn’t until 1979 that the company changed its name to Mastercard, reflecting its global expansion.

Today, Mastercard operates in over 210 countries and territories, processing more than 74 billion transactions annually. It offers a wide array of products and services, including credit, debit, and prepaid cards, as well as mobile and contactless payment solutions. Additionally, the company also provides fraud protection services and analytics to help businesses make informed decisions.

With such a vast reach and diverse range of offerings, it’s no surprise that Mastercard has been able to generate significant revenue over the years. Let’s take a closer look at the numbers and see how they stack up.

Mastercard’s Annual Revenue Growth Analysis

Over the years, Mastercard’s revenue has been on a steady upward trajectory. According to the company’s financial reports, its revenue has grown every year since it went public in 2006. In the fiscal year of 2019, Mastercard reported a record-high revenue of $16.9 billion, an increase of 13% from the previous year. This growth was mainly driven by an increase in cross-border volume and gross dollar volume, both of which we will explore further in later sections.

| Fiscal Year | Revenue (in billions) | Year-over-Year Growth |

|---|---|---|

| 2006 | $3.3 | – |

| 2007 | $3.9 | 18% |

| 2008 | $5.1 | 31% |

| 2009 | $4.0 | -22% |

| 2010 | $5.0 | 25% |

| 2011 | $6.7 | 34% |

| 2012 | $7.4 | 11% |

| 2013 | $8.3 | 12% |

| 2014 | $9.5 | 15% |

| 2015 | $9.7 | 2% |

| 2016 | $10.8 | 11% |

| 2017 | $12.5 | 16% |

| 2018 | $14.9 | 19% |

| 2019 | $16.9 | 13% |

As shown in the table, Mastercard’s revenue grew at an average rate of 16% per year from 2006 to 2019. This impressive growth can be attributed to various factors, including an increasing global trend towards cashless payments, the company’s expansion into new markets, and its innovative products and services.

Cross-Border Volume – A Key Driver of Mastercard’s Revenue Growth

One of the main factors contributing to Mastercard’s revenue growth is cross-border volume. This refers to the volume of transactions made by cardholders from one country to another. Mastercard’s extensive network and partnerships with banks and merchants worldwide have enabled it to process a significant volume of cross-border transactions, resulting in substantial revenue.

According to Mastercard’s financial reports, cross-border volume has been steadily increasing over the years, with a growth rate of 13% in 2019. In that year alone, Mastercard processed $1.4 trillion worth of cross-border transactions. This growth can be attributed to several factors, including increased travel and tourism, rising international e-commerce, and the adoption of digital payment solutions.

To maintain this growth, Mastercard has been investing heavily in expanding its global presence through strategic partnerships and acquisitions. For instance, in 2018, the company acquired Transfast, a leading cross-border remittance provider, to strengthen its presence in the fast-growing digital remittance market. Such investments have not only boosted Mastercard’s revenue but also helped it cater to the evolving needs and preferences of consumers worldwide.

The Impact of COVID-19 on Cross-Border Volume

While Mastercard’s revenue and cross-border volume have been steadily growing, the outbreak of the COVID-19 pandemic in early 2020 had a significant impact on the company’s operations and revenue. With many countries imposing travel restrictions and lockdowns, the volume of cross-border transactions decreased significantly.

In its quarterly earnings report for the first quarter of 2020, Mastercard reported a decline in cross-border volume by 7% compared to the same period in 2019. This was mainly due to the sharp decline in international travel and tourism, which accounts for a significant portion of cross-border transactions.

However, as the world starts to open up again and travel restrictions are eased, Mastercard’s cross-border volume is expected to bounce back. In its second-quarter earnings report, the company reported an 18% increase in cross-border volume compared to the previous quarter, showing signs of recovery.

Gross Dollar Volume – Another Key Component of Mastercard’s Revenue

Gross Dollar Volume – Another Key Component of Mastercard’s Revenue

Apart from cross-border volume, gross dollar volume (GDV) is another crucial component of Mastercard’s revenue. GDV refers to the total value of purchases made using Mastercard-branded cards, including credit, debit, and prepaid cards. It’s also an indicator of consumer spending trends, making it a key metric for analyzing the company’s performance.

Mastercard’s gross dollar volume has been on a steady rise over the years, with an average growth rate of 10% per year. In 2019, the company reported a total GDV of $5.8 trillion, an increase of 8% from the previous year. This growth can be attributed to increased consumer spending, especially in emerging markets, where there is a growing demand for digital payment solutions.

| Fiscal Year | Gross Dollar Volume (in trillions) | Year-over-Year Growth |

|---|---|---|

| 2006 | $1.3 | – |

| 2007 | $1.4 | 8% |

| 2008 | $1.7 | 21% |

| 2009 | $1.5 | -12% |

| 2010 | $1.9 | 24% |

| 2011 | $2.5 | 33% |

| 2012 | $2.7 | 11% |

| 2013 | $2.9 | 7% |

| 2014 | $3.2 | 11% |

| 2015 | $3.3 | 3% |

| 2016 | $3.8 | 15% |

| 2017 | $4.5 | 18% |

| 2018 | $5.0 | 12% |

| 2019 | $5.8 | 8% |

As shown in the table, Mastercard’s gross dollar volume has been on a consistent upward trend, even during the global economic downturn in 2008-2009. This shows the company’s resilience and its ability to adapt to changing market conditions.

The Impact of COVID-19 on Gross Dollar Volume

Similar to cross-border volume, the COVID-19 pandemic also had a significant impact on Mastercard’s gross dollar volume. In its first-quarter earnings report for 2020, the company reported a decline in GDV by 1% compared to the same period in 2019. This was due to reduced consumer spending as a result of lockdowns and economic uncertainty.

However, with the gradual reopening of economies and increased online shopping, Mastercard’s gross dollar volume is expected to bounce back in the coming months. As more consumers switch to digital payment methods, Mastercard is well-positioned to capitalize on this trend and continue its growth trajectory.

The Power of Partnerships – Mastercard’s Secret to Success

One factor that has contributed significantly to Mastercard’s success is its strategic partnerships. The company has forged alliances with banks, merchants, and other financial institutions worldwide to expand its customer base and drive revenue. In addition to expanding its global reach, these partnerships have also helped Mastercard stay at the forefront of the ever-changing payments landscape.

In recent years, Mastercard has focused on building strategic partnerships with technology companies to enhance its offerings and provide innovative solutions to customers. For instance, in 2019, the company teamed up with Apple to launch the Apple Card, a digital credit card that leverages Mastercard’s payment network. The following year, Mastercard also partnered with Samsung to enable consumers to make contactless payments using their Samsung smartwatches.

Apart from technology companies, Mastercard has also established partnerships with governments to drive financial inclusion and promote digital payments. In 2020, the company partnered with the government of Nigeria to issue digital IDs to its citizens, allowing them to access financial services conveniently and securely.

Mastercard’s Partnership with Banks

Another crucial aspect of Mastercard’s partnership strategy is its relationships with banks. The company partners with banks worldwide to issue Mastercard-branded cards to their customers. As a result, Mastercard has been able to expand its customer base significantly, with over 3 billion cards in circulation globally.

Moreover, these partnerships have also allowed Mastercard to offer customized products and services to cater to the specific needs of each bank’s customer base. For instance, the company offers co-branded cards with airlines, retail stores, and other businesses, providing added benefits and rewards to cardholders.

Furthermore, Mastercard’s partnerships with banks have also enabled it to tap into the rapidly growing market for mobile payments. By collaborating with banks, the company can leverage their existing infrastructure and reach more consumers who prefer using their smartphones for transactions.

Innovation – Driving Mastercard’s Revenue Growth

Innovation – Driving Mastercard’s Revenue Growth

Next, we’ll take a closer look at how Mastercard’s focus on innovation has contributed to its revenue growth over the years. The company has always been at the forefront of technological advancements, continuously introducing new products and services to meet the changing demands of consumers and businesses.

One of Mastercard’s most notable innovations is its contactless payment technology, which enables consumers to make transactions by tapping their cards or phones at a point-of-sale terminal. This technology has been gaining popularity in recent years due to its speed and convenience, and Mastercard has been at the forefront of driving its adoption.

According to Mastercard’s financial reports, over 85% of its transactions are now contactless, with a growth rate of 40% in 2019 alone. The company has also been investing in biometric authentication technology to enhance security and convenience for customers across its payment network.

Moreover, Mastercard’s focus on innovation goes beyond products and services. The company has also invested heavily in data analytics to help businesses make informed decisions. Its “Mastercard SpendingPulse” platform provides real-time insights into consumer spending trends, helping businesses identify growth opportunities and make data-driven decisions.

Mastercard’s Investment in Startups and Emerging Technologies

Besides internal innovation, Mastercard has also been investing in startups and emerging technologies to stay ahead of the curve. The company has established several programs and partnerships to support the growth of fintech startups and drive innovation in the payments industry.

For instance, Mastercard launched a startup accelerator program called “Start Path” in 2014, which helps early-stage companies develop and scale their businesses. It has also partnered with venture capital firms to invest in promising startups, including those focused on digital identity verification and blockchain technology.

Apart from investing in startups, Mastercard has also been collaborating with universities and research institutions to explore emerging technologies such as artificial intelligence and machine learning. This investment in future technologies ensures that Mastercard stays relevant and continues to drive revenue growth in the long run.

The Impact of COVID-19 on Mastercard’s Operations and Revenue

As mentioned earlier, the COVID-19 pandemic had a significant impact on Mastercard’s operations and revenue in 2020. With countries implementing lockdowns and social distancing measures, consumer spending patterns changed drastically, resulting in reduced revenue for the company.

In its quarterly earnings report for the first quarter of 2020, Mastercard reported a decline in net income by 11% compared to the same period in 2019. This was mainly due to a decrease in cross-border volume and gross dollar volume, as well as higher expenses related to the pandemic.

However, Mastercard’s management is confident that the company will bounce back from the impact of the pandemic. The company has been working closely with governments, businesses, and consumers to adapt to the new normal and drive digital payments forward. With its robust partnerships, innovative solutions, and strong financial position, Mastercard is well-positioned to come out of this crisis stronger than ever.

Conclusion

In conclusion, Mastercard’s revenue statistics tell an impressive story of growth and success. From its humble beginnings in 1966 to becoming a global leader in electronic payments, Mastercard has achieved remarkable growth over the years. Its focus on innovation, strategic partnerships, and investments in emerging technologies have enabled it to stay ahead of the curve and continue driving revenue.

While the COVID-19 pandemic has undoubtedly had a significant impact on Mastercard’s operations and revenue, the company’s response to the crisis has shown its resilience and ability to adapt. As we move towards a more cashless society, Mastercard is well-positioned to capitalize on this trend and continue its growth trajectory in the years to come.

Post Comment